Traded in London Stock Exchange. - Ticker: AAF

Market Capitalization: £4.810 mln / U$D 6.445 mln

This research is by way of presentation, it does not represent a recommendation to buy or sell but an investment idea and an expression of our opinion about the company.

THE COMPANY

Airtel Africa is a leading provider of telecommunications and mobile money services, with a presence in 14 countries in Africa, primarily in East Africa and Central and West Africa. Airtel Africa has a number of direct and indirect subsidiaries, including telecommunications companies, through which the Group provides mobile and fixed voice and data services, mobile commerce companies, through which the Group provides mobile financial services (“MFS”), tower companies, through which the Group holds its tower portfolio and a submarine cable company, through which the Group has access to submarine cables to support the provision of international voice and data services.

Business model emphasises local decision-making and responsibility through a decentralised organisational structure, in which local managing directors retain substantial autonomy regarding the management and oversight of operations in their local markets.

The group sells the majority of its services through physical locations across its footprint, which included approximately 19,700 retail touchpoints, including kiosks and minishops and Airtel Money branches, other than SIM selling outlets and recharge selling outlets as of 31 March 2019.

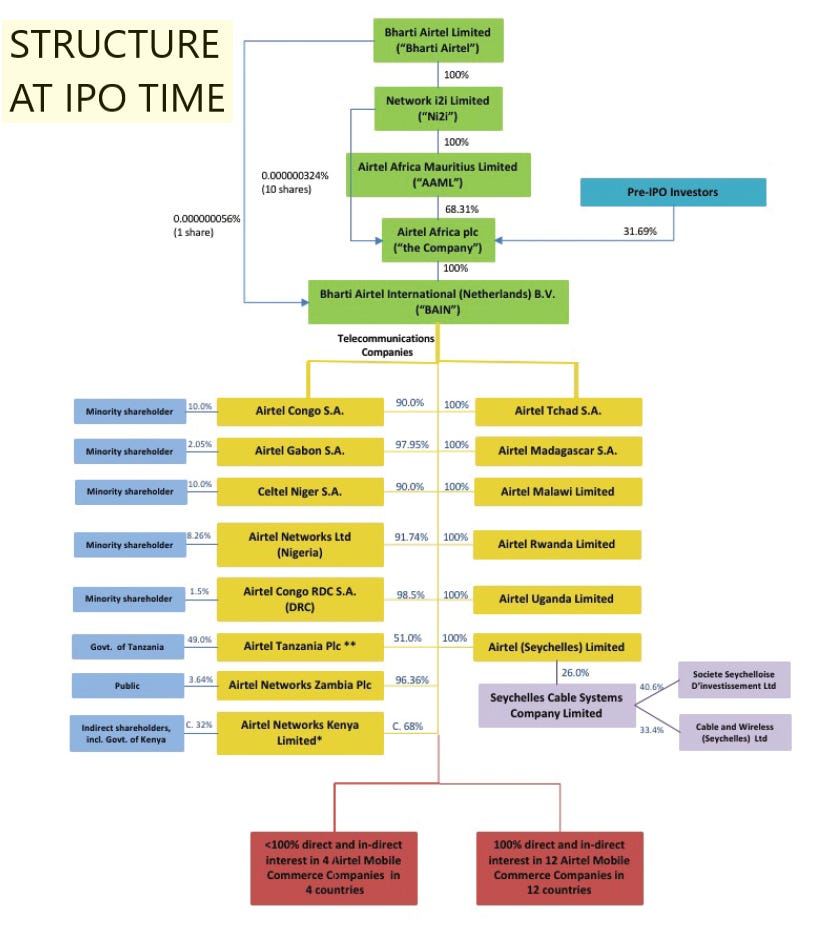

THE PRINCIPAL SHAREHOLDER

Bharti Airtel Limited is a leading global telecommunications company with operations in 18 countries across Asia and Africa. Headquartered in New Delhi, India, the company ranks amongst the top 3 mobile service providers globally in terms of subscribers. In India, the company's product offerings include 2G, 3G and 4G wireless services, mobile commerce, fixed line services and high speed home broadband.

Sunil Bharti Mittal is an Indian billionaire entrepreneur, philanthropist and the founder and chairperson of Bharti Enteprises, which has diversified interests in telecom, insurance, real estate, education, malls, hospitality, Agri and food besides other ventures.

THE CEO

In October 2021, Airtel Africa announced the appointment of Olusegun "Segun" Ogunsanya, as Managing Director and Chief Executive Officer (CEO). Segun was previously Managing Director and CEO of Airtel Nigeria and was responsible for the overall management of the operations in the Company's largest market. He has more than 25 years business management experience in banking, consumer goods and telecoms. Before joining Airtel in 2012, Segun held leadership roles at Coca-Cola in Ghana, Nigeria, and Kenya (as MD and CEO). He has also been the Managing Director of Nigerian Bottling Company Ltd (Coca-Cola Hellenic owned) and Group head of retail banking operations at Ecobank Transnational Inc, covering 28 countries in Africa. He is an electronics engineer and also a chartered accountant.

INTERVIEW WITH SEGUN OGUNSANYA

We are going to present the company with very interesting comments made by Mr. Ogunsanya during the last conference call, to better understand each point that we stopped to analyze about Airtel Africa.

MACROECONOMIC CONTEXT AND GEOGRAPHICAL ADVANTAGES1

Africa is one of the world’s fastest growing regions, whether measured by GDP growth, population and urbanisation growth, or in terms of rising income levels and an increasing middle class. The IMF World Economic Outlook Database forecasts African nominal GDP to grow at a CAGR of 6.9% from 2018 to 2023.

The population in the Group’s 14-country footprint, which represents around 53% of the population of Sub-Saharan Africa, is forecast to grow at a CAGR of 2.8% between 2018 and 2023.

Population growth - Sub-Saharan Africa

Africa has so many women of childbearing age that even if most decided to have fewer babies today, the population would keep expanding.2

In addition to absolute population growth, Africa is one of the fastest urbanising continents in the world. Between 2015 and 2050, the percentage of the African population living in cities is forecast to increase from approximately 40% to 60%, representing an additional 997 million people, equivalent to a CAGR of 3.2% over the period, according to forecasts by the United Nations. The urban population of the Group’s footprint represented 40.0% of the total in 2018 according to Delta Partners.

The middle class in Africa is also expected to grow. Deloitte defines the African middle class as people with earnings between US$2 to US$20 per day. Following this definition, Africa’s middle class was approximately 376 million individuals in 2013 and is forecast to grow, with the African middle class expected to reach 582 million by 2030.

Urbanisation and an expanding middle class are drivers of increased household consumption in Africa. Household consumption across Africa has grown 56% from US$910 billion in 2005 to US$1,420 billion in 2015 and is forecast to increase 45% to US$2,065 billion in 2025, according to McKinsey. These statistics position Africa as the second fastest region behind Asia in terms of household consumption growth.

Population growth and rapid urbanisation coupled with a growing middle class are expected to continue to drive the need for infrastructure projects across Africa.

McKinsey forecasts infrastructure spending in Africa to almost double from US$80 billion per year in 2015 to US$150 billion per year in 2025, with 68% to be spent on power and transportation and the remainder to be spent on the water and telecom sectors.

Airtel opportunity is further supported by the lack of legacy fixed broadband infrastructure in SubSaharan Africa and increasing affordability of smartphones in emerging markets, particularly in Africa.

In 2017, fixed broadband household penetration stood at 7.4% compared to North America (87.5%), Europe (83.9%), Asia Pacific (70.4%) and Latin America (42.9%), increasing the impetus on mobile networks to be the primary source of internet access. In the same period, the average selling price of smartphones in Sub-Saharan Africa stood at US$101 (down 56% compared to 2012) compared to US$163 in Latin America and US$155 in Asia Pacific. The relative affordability of smartphones and access to the expanding 3G/LTE connectivity in Africa is expected to drive uptake of smartphones in Africa, with smartphone penetration expected to increase from 19% in 2018 to 51% in 2023 across the Group's footprint (excluding Chad) according to Delta Partners. This in turn provides a sizable data opportunity in the Group’s markets, with datasubscribers expected to triple between 2018 and 2023.

The Sub-Saharan African market is characterised by limited access to formal financial institutions with limited banking infrastructure; as of 2017, there were only 7.4 bank branches for every 100,000 adults in Sub-Saharan Africa according to Delta Partners. In Sub-Saharan African countries, less than half of the population has a bank account, which places the region significantly below other emerging market regions including Latin America and emerging Asian markets. This has set the stage for growth in MFS (mobile financial services). Sub-Saharan Africa has among the lowest rates of financial banking penetration, and mobile-money is expected to remain at the forefront of financial inclusion in the region. The penetration rate for MFS (total registered mobile money users / total population) varies across the Group’s footprint, with markets like Kenya having over 60% penetration, while other markets are newly embracing the mobile money opportunity, such as Nigeria, which adopted a new regulating framework for mobile money users in October 2018. Just this year the central bank has issued a preliminary approval to Airtel and MTN to offer mobile money services and help the country achieve its ambitious financial inclusion targets.

THREE MAIN BUSINESS LINES

The Group operates in three main business lines, mobile voice, mobile data and Airtel Money (mobile money).

Mobile voice: The mobile voice business line comprises pre- and post-paid wireless voice services, international roaming, fixed-line telephone services and interconnect revenue paid to the Group by other telecommunications providers. The mobile voice business line is the largest component of the Group’s revenue, representing 53% in the year ended 31 March 2021.

Mobile data: The mobile data business line comprises data communications services, including 2G, 3G and, increasingly, 4G data services, and other VAS (Value-Added Service) for mobile subscribers. The mobile data business line accounted for 29% Group’s consolidated revenue in the year ended 31 March 2021.

Airtel Money – Mobile money services, offered under the Airtel Money brand, are an increasingly important part of the Group’s service offerings. The Airtel Money business line comprises a mobile commerce service that is accessible 24 hours a day, 7 days a week through customers’ mobile devices.

Working in partnership with local financial institutions, this service enables Airtel Money customers to send and receive money and to make payments for utility bills and, in certain countries, to pay for goods and services, to deposit and withdraw funds through a linked bank account, to make card-less withdrawals from partnered ATMs and to access microloans, which are facilitated by the Group and accessible through its mobile network in partnership with third-party loan providers. Airtel Money services are available across the Group’s footprint in which the Group serves 23.9 million customers.

The Group has offered mobile services in Africa since 2010 and has leveraged this experience to roll out relevant products and services across its footprint. The Group offers a range of country specific entertainment, lifestyle and general content through its VAS products. The Group aims to continue positioning its non-voice businesses, in particular through its investments in value-added digital services and continued expansion of mobile money services, as an opportunity for longterm sustainable growth in response to the rapidly changing telecommunications environment in the markets in which the Group operates.

The first thing we see when we start to analyze Airtel Africa is a base business: voice communications via mobile. Based on this business, Airtel Money adds data clients (mobile internet). And these data customers start using the Airtel Money app. This constitutes a path that Airtel Africa users follow. A user starts by hiring Airtel Africa to be able to communicate, and then uses the application to be able to make payments in his daily life. In the words of the company: "provision of essential services to customers and communities has fed our profitable growth, which in turn sustains our ability to keep advancing digitalisation and expanding financial inclusion in underserved markets. It is a virtuous circle that our strategy is designed to maintain and it is a clear expression of our purpose of transforming lives."

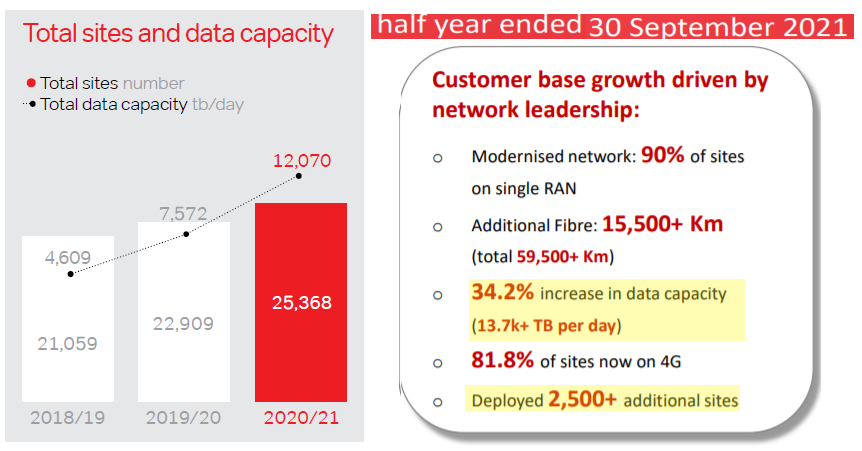

Win with network

In 2020/21, Airtel Africa deployed more than 2,400 additional sites3, reaching 25,368 sites in total as of 31 March 2021. During the year, Airtel Africa added more than 3,400 sites to 3G (94% of sites are on 3G), more than 4,500 sites to 4G (76.5% of sites are on 4G) and added 11,500km of fibre (54,500+ km of fibre as on 31 March 2021). Data capacity increased by 59.4% to 12,070 terabytes (TB) per day, with peak hour data utilisation at 45%.

In the first six months of FY2022, Airtel Africa continued to add sites, data capacity and km of data fibre.

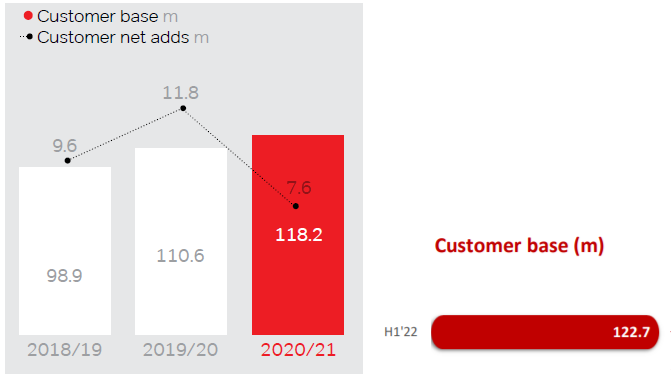

Win with customers

Airtel Africa overall customer base grew by 6.9% to 118.2 million as of 31 March 2021 – despite no new customer onboarding in Nigeria since December 2020 (growth was 10.7% excluding Nigeria). The customer base shows constant growth. For the year ended March 2021, growth was lower due to a new Nigerian regulation: “Following a directive issued by the Nigerian Communications Commission (NCC) on 15 December 2020 to all Nigerian telecom operators, Airtel Nigeria has been working with the government to ensure that all our subscribers provide their valid National Identification Numbers (NINs) to update SIM registration records; Initially, new customer acquisitions were barred until significant progress had been made on linking the active customer base with verified NINs. Natural churn in the customer base led to a loss of 2.5 million active mobile customers in the final quarter of the year.”

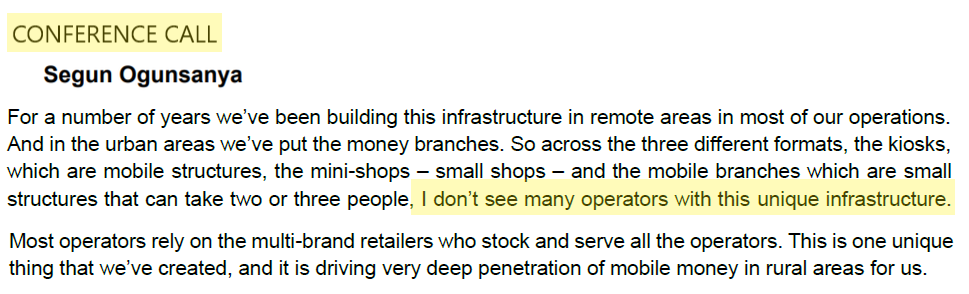

This growth reflects Airtel Africa continuous focus on investment in sales and distribution infrastructure in urban and rural markets, including the exclusive distribution channel of kiosks and Airtel Money branches. The enhanced distribution channel ensures availability of SIM cards, recharge cards and money float.

Airtel Africa voice traffic grew by 29.1% to 322.9 billion minutes in 2020/21. Increase in voice traffic was driven by Airtel customer base growth of 6.9%, and an increase of usage per customer of 16.4% to 234 minutes per customer per month. Voice usage growth was mainly driven by the expansion of rural network coverage, investment in rural sales and distribution infrastructure, and by customer adoption of Airtel Africa ‘more-for-more’ voice bundles.

In the first half of FY2022, voice usage per customer grew to 253 minutes. Voice revenue growth is approximately 9% for FY2022. This represents real growth in this segment, which is reflected in the segment's revenue.

Win with data

Data customer base increased by 14.5% to 40.6 millions as of 31 March 2021 and 8.1% in six months of FY2022 to 43.9 millions: “Data customer base growth was driven by expansion of data network, increase in data capacity and 3G and 4G enabled smartphones.”

Data customer penetration also increase from 30% in 2018/2019, to 37% in 1H 2021/2022.

But Airtel not only had growth in the number of data customers and penetration over total customers, but also a significant growth in the amount of data usage per customer and therefore, in revenue…

Win with mobile money

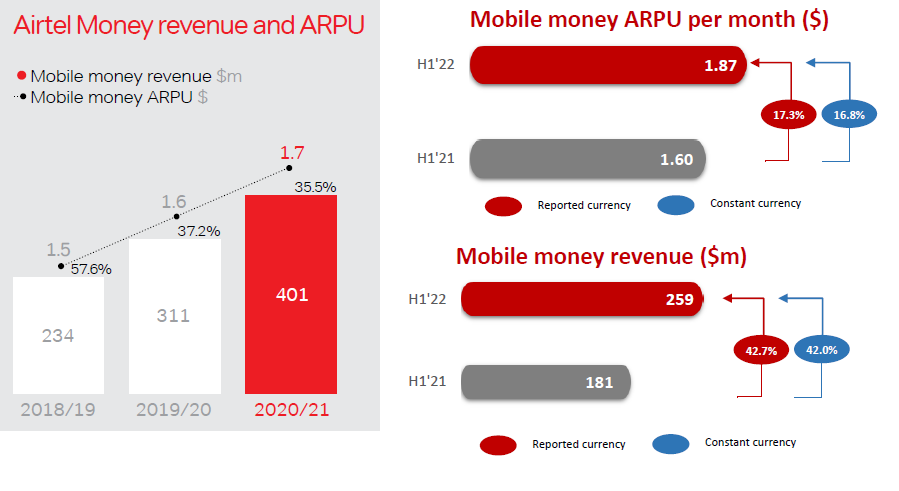

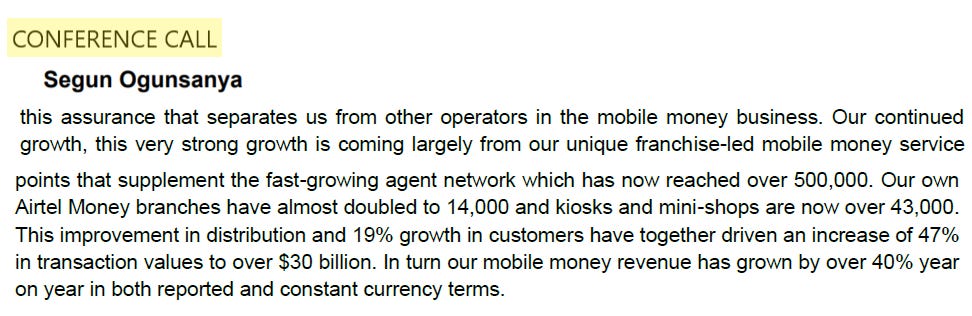

Airtel Money customer base grew by 18.3% in 2021/2022. The increase in contributions from merchant payments, cash transactions, P2P transfers and mobile services recharges through Airtel Money have helped grow the mobile money transaction value even faster at 53.6%, enabling mobile money revenues to grow by 35.5%.

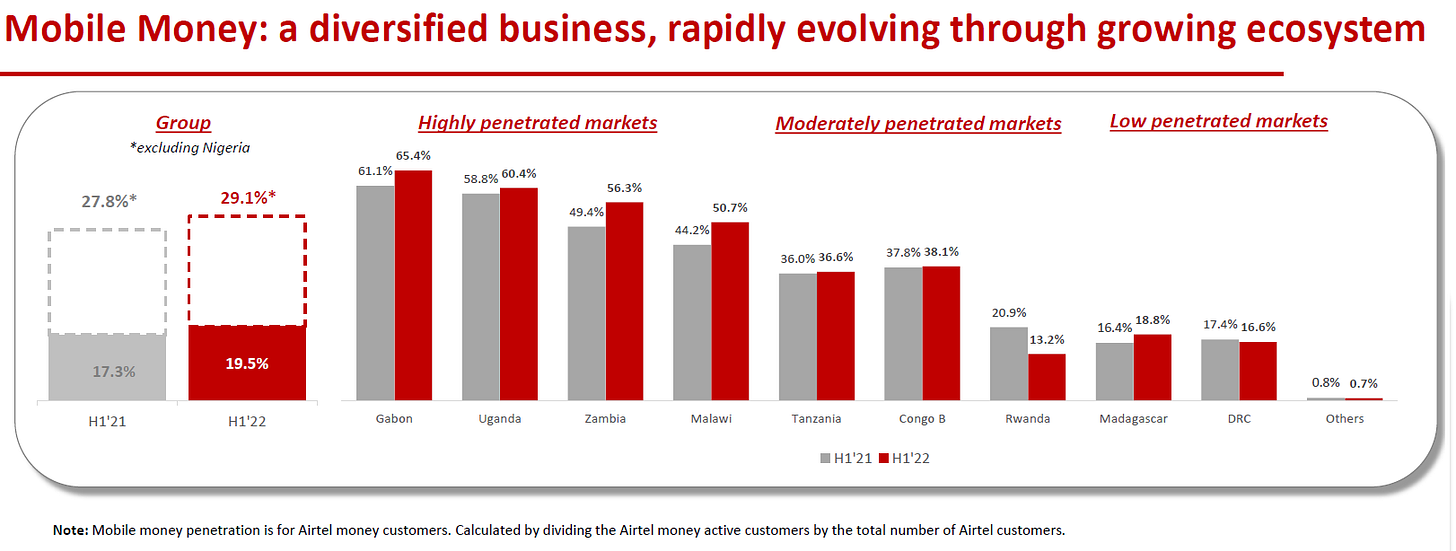

Airtel Money's customer base grew 10% in just six months. And penetration over total customers amounted to 19.5%.

If we annualize the Airtel Money transaction value of H12020 / 2021, Airtel Africa has a growth of 31% in relation to the previous full year. It is notable that from the year 2018/2019 to the estimate for 2021/2022, the total growth has been 146%, even with the Covid pandemic involved.

In addition to the increase of the revenue of Airtel Money of 30% annualizing the first semester of the current fiscal year, the ARPU (Average revenue per unit) also increases. If the new customers of Airtel Money, together with old customers, increase ARPU is very good.

We found it interesting to take the total population of the 13 countries (excluding Seychelles) to conclude that 24% of the inhabitants of these countries are customers of Airtel Africa.

And at the end of the ecosystem, only 4.6% of the total population uses Airtel Money, generating 401 mln USD of revenue. Consider that if the population growth rate of Sub-Saharan Africa is 2.7% per year. If that rate is maintained, within 20 years the population of these countries should be almost 900 million people... almost double the current population.

CUSTOMERS AND REVENUES GROWTH

After analyzing the growth of each segment of Airtel Africa, this table summarizes the growth rates and adds the growth of the total revenue of Airtel Africa.

The difference in maturity of each segment is very clear in the growth rates. The Voice segment is the one with the "lowest" rates, with revenue growth of 9.4% annualized in the first half of the current year. While the growth rates of the Data and Mobile Money segments are 26% and 29% respectively.

Airtel Africa's strategy is to invest in increasing capacity and connectivity, along with open of branches where customers can hire Airtel services. Thus, they are creating a market in countries where internet penetration is still very low, the penetration of services with greater added value such as those offered by Airtel Money is even lower. The interesting thing is that although Airtel Africa has competition in all the countries where it operates, it also happens that in many areas of the 14 countries where Airtel Africa operates, the company creates a market by being the first service installed, with all the advantages that it implies "being the first to arrive".

The interesting thing is that if we look at the penetration rates of Airtel Money, it is still quite low in relation to Airtel's customer base. Therefore, we have growth opportunities due to population growth, customer base growth, and the low penetration of the fintech platform that will be used daily by each new Airtel Africa customer.

AIRTEL MONEY - GROWTH VALUATION?

Taking into account the growth rates of revenue from Airtel Money, should we think Airtel Africa as a Growth company, with the high valuations that they usually have?

If we take the full revenue of Airtel Africa, the current Market Cap is equivalent to only 1 year of revenue. If we take only the revenue from Airtel Money, Airtel Africa is traded to 12 years of revenue from Airtel Money.

But let's put aside the interpretations about whether Airtel Africa has to be valued as a Growth company or a value company, because we believe that it can be thought of as a company that has both qualities within. And we don't want to estimate how much Airtel Africa should earn after 10 years growing at 15% per year. We prefer to take current numbers.

We always choose to value companies by taking after-tax operating cash flow, but before cash flow for investing activities, even more companies such as Airtel Africa where annual capital expenditures of USD 650 mln are projected.

The operating free cash flow adjusted for first six months of FY2022 is USD 866 mln, showing a growth of 28% against the six months of the same period of the previous year.

If we annualize this number to USD 1,732 mln, Airtel Africa is trading at 3.6 years. The group also reports free cash flow, understood as net cash generated from operating activities after lease repayments, cash capex (including purchase / renewal or f license & spectrum), cash interest, payment to minorityshareholders in subsidiary companies. It excludes dividend payments to Airtel Africa shareholders, the effects of acquisitions and disposals, the effects of extraordinary events, etc.

In this case, the annualized Free cash flow would be USD 614 mln, and Airtel Africa would be trading at 10 years of FCF. To highlight the growth of free cash flow in 1H2022 of 192%.

DEBT

Taking the IPO prospect, we find significant reductions in net debt, but Airtel Africa focuses on debt in relation to profit generation, using the Net debt / Underlying EBITDA ratio.

The reduction in the ratio from 9 in 2017 to the current 1.5 is notable.

Adding the net debt to the market capitalization, the enterprise value would be USD 9,348 mln. Taking that Enterprise Value and our adjusted operating cash flow, Airtel Africa is trading at 5.4 years

DIVIDEND

The Board has recommended a final dividend of 2.5 cents per share for the fiacal year ended in March 2021.

In October 2020 the Board approved a new progressive dividend policy during the period due to the combination of continued strong business performance, significant opportunities to invest in future growth and the aim to continue to reduce leverage. The newly adopted dividend policy aims to grow the dividend annually by a mid to high single digit percentage from a base of 4 cents per share for FY 2021, until reported leverage (calculated as net debt to underlying EBITDA) falls below 2.0x .

In March 2021 the company said: “At the point when reported leverage (calculated as net debt to underlying EBITDA) is below 2.0x, the Board will reassess the dividend policy in the light of the prevailing growth outlook for the Group.”

In half year ended in September 2021, the ratio fell to 1.5x, and the interim dividend increase from 1.5 cent to 2 cent, in line with an upgraded dividend policy.

RISKS

As in any investment, it is always good to take into account what are the inherent risks of the business, and in this case we bring up some of the risks that Airtel Africa names in its IPO prospectus. There are many more, we only share the ones that we found most interesting.

“The Group may also be exposed to a lack of certainty with respect to the legal systems in a number of countries in which it operates, and, such legal systems may not be immune from the influence of political pressure, corruption or other factors that are inconsistent with the rule of law, and of which could have a material adverse effect on the Group’s business, results of operations and financial condition.”

“The operation of telecommunications networks and the provision of related services are regulated to varying degrees by national, state, regional or local governmental and regulatory authorities in the countries where the Group operates. The Group’s operating licences or authorisations specify the services it is permitted to offer. The operating licences are subject to review, interpretation, modification or termination by the relevant authorities and the regulatory framework applicable to such licences may be amended from time to time.”

“The Group operates in an increasingly competitive environment, particularly with respect to pricing and market share, which may adversely affect its revenue and margins.”

Undoubtedly one of the points to criticize Airtel Africa is the level of competitiveness of the sector. Airtel Africa has competition in all countries. In the 4 most populated countries where it operates, it is not number 1 in the market share. But we have also seen current market share data from some of those countries, and compared to the data from the IPO prospect (2018), they have not changed much, even in 3 of them the position of Airtel Africa has increased 1%. Because of the competition, perhaps the market share remains the same, but the customers increase.

The difficulty involved in starting a company like Airtel Africa, and the other operators, in countries like these, implies a great defensive moat. And for us, having a 25% -50% market share, is an important safety margin, as it is a basic service with recurring revenue.

And taking into account that in recent years the number of customers has only increased, the discussion is more about the speed at which each company is going to grow, rather than the loss of customers. There is plenty of market to grow, outside and inside the Airtel Africa ecosystem.

“The Group’s revenue and operations are and will remain highly dependent on the macroeconomic environment in the 14 countries across Sub-Saharan Africa in which it operates its networks, and the economic and political conditions in certain of these countries or in Sub-Saharan Africa more generally may not be favourable in the future.”

“Fluctuations in foreign currency exchange could increase the operating and debt servicing costs of, and the financial burden on, the Group and any hedging transactions involve risks that can harm the Group’s financial performance. movements in exchange rates between these currencies and the US dollar could have a negative effect on the Group’s results of operations and financial condition to the extent there is a mismatch between its earnings in any foreign currency and its costs that are denominated in that currency. Foreign exchange rates have seen fluctuation in recent years, and foreign exchange movements in Africa can be particularly volatile.”

A clear example of exposure to the devaluation and availability of USD occurred precisely these months in Nigeria.

Investing in Airtel Africa certainly means being exposed to the macroeconomics of 13 countries (and Seychelles). We do not intend to do an exhaustive study (yet) of each country, but it is necessary to check that these countries have a balanced economy with respect to the entry and exit of foreign exchange, level of reserves, trade balance, currency devaluation ... because, after all, the earnings of each Airtel Africa subsidiary will eventually have to exchange earnings in local currency for US dollars to remit profits. It is also true that even with devaluations lower than the growth rate of Airtel Africa, the equation remains favorable for the company.

In our PDF we have collected data that are relevant to us and we want to highlight some of the data that have surprised us:

Of the 13 countries studied, all have very high population growth rates, which we find very interesting for our intention to buy for the very long term.

Of the 13 countries, the only one that has had more than 1 year of negative growth was the Republic of Congo.

The Nigerian Naira has devalued 28% in the last 5 years.

The franc of the African financial community is the common currency of Niger, Chad, Gabon and the Republic of Congo (among others), the latter 3 with clear exposure to the price of oil. After the 2014 oil crash, the CFA franc has not devalued!

The franc of the Democratic Republic of the Congo has devalued 100% in the last 5 years, the Zambian Kwacha 60%. The improvement in the economies of these two countries is very clear just with the rise in the price of copper, both are net exporters of Copper and are undoubtedly exposed to fluctuations in the price of the red metal and the growth of China. During 2021 Zambia's reserves have exploded and those of the Democratic Republic of the Congo have reached 5-year highs.

The rest of the countries have devalued their currencies between 10% and 50%. To highlight the strength of the Ugandan shilling, the Malawi Kwacha and the Tanzanian shilling.

Worst devaluation happened in the Democratic Republic of the Congo, which undoubtedly has one of the best prospects for the future with its immense reserves of Cobalt and Copper.

Nigeria, Chad, Gabon and the Republic of the Congo are countries with a positive trade balance due to their oil export capacity. Zambia and the Democratic Republic of the Congo also have a positive trade balance due to metal exports, mainly Copper. Uganda, Malaqwi, Kenya, Madagascar, Tanzania and Rwanda are countries with negative trade balances, dependent on the export of some type of raw material, but with high level of reserves: Kenya with USD 14,000 mln, Uganda with USD 4,300 mln or Tanzania with USD 5,000 mln, for example.

It is also interesting to note that the Republic of the Congo owes 100% of its GDP, but the rest range between 65% of Kenya, and 15% of the Democratic Republic of the Congo. In general, the level of indebtedness is quite low.

It is important to contrast these interesting macroeconomic data with complicated political situations in several of the countries where Airtel Africa operates. Boko Haram is the name by which a fundamentalist Islamic terrorist group is known that operates mainly in northern Nigeria, in the Lake Chad area located on the border between Chad, Niger and Cameroon. In Chad, after the death of President Idriss Déby Itno in April 2020, the army dissolved the government and parliament and established a military council, the Transitional Council, which is expected to rule for 18 months. Some terrorist also operate in the common border between Uganda and the Democratic Republic of the Congo. To fight them more effectively both countries have recently agreed to pool their efforts to conduct joint operations against these common enemies. The current famine in southern Madagascar is due to poverty and natural variations in the climate, the southern half of this island, located in the Indian Ocean, suffers an extreme drought, unprecedented for decades, which has precipitated 1.3 million people to a state of acute malnutrition. These are just a handful of all the problems that the African continent is going through, and they surely explain the significant discount in the Airtel Africa price.

“The Group’s operating costs are subject to fluctuations, including in response to changes in global commodity prices, including energy consumption costs (such as diesel and electricity) and hard commodities (such as steel and zinc), the cost of obtaining and maintaining licences, spectrum and other regulatory requirements, market uncertainty and prevailing macroeconomic conditions and a variety of additional factors beyond the Group’s control. The Group is not subject to price regulation with respect to retail prices in 11 of the 14 countries in which it operates. In those countries, the relevant government does not set a maximum price at which the Group is able to offer its services to customers.”

We review the regulations on tariffs. The only country that seems to be tougher on updating rates is Nigeria, we have even verified that both MTN and Airtel have practically the same prices for the same services. In most countries, tariff increases require regulatory approval. These regulations have not prevented the great growth of revenue and the entire ecosystem of Airtel Africa.

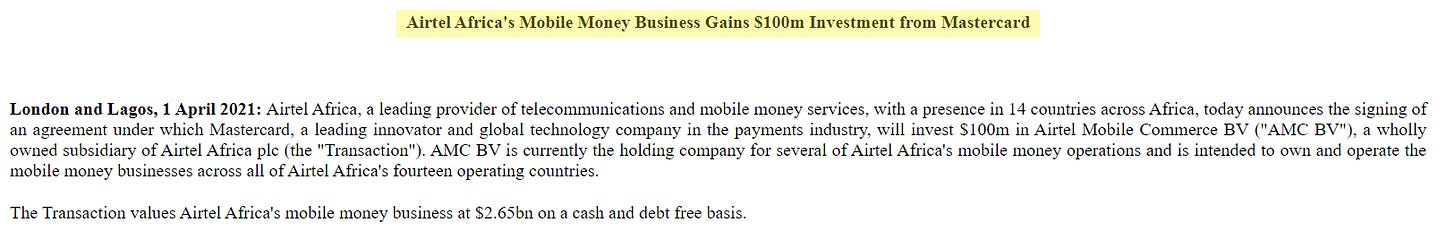

AIRTEL MONEY

Undoubtedly the great expectations with Airtel Africa are for the Airtel Money segment. As you can see in the PDF attached to this research, Airtel Money has services in common in each country, but in some cases there are services that are not in all countries. The electronic wallet service to pay bills, the possibility of sending money or receiving money from abroad and recharging the credit for the cell phone is in almost everyone.

Borrowing money, using Airtel Money to request a virtual Mastercard credit card, paying in stores or for services, are some of the services present in some of the countries, but not in all.

Airtel Africa aims to monetise its mobile money business with minority investments up to a total of 25% of the issued share capital, and to explore the potential listing of the mobile money business within four years.

CONCLUSIONS

Leaving aside the enormous growth possibilities both in the data segment and with the business that Airtel Money offers, we believe that the current valuation of Airtel Africa is very attractive to take a long-term position.

The ecosystem created by Airtel Africa, where through the base business, the client ends up using Airtel Money for their daily life, we think it's fantastic. If the company does things well, the growth of Airtel Money has no ceiling.

If we think that Airtel Africa trades at 3.6 years of profit before Capex, being a business with recurring income, we cannot stop thinking about the risks that the market sees in the countries where Airtel Africa operates. Where others see risks, we see opportunities, growth opportunities, recurring income, and very high future dividends.

But these risks must be taken into account and at least taken into account to take a position and evaluate them over time: undoubtedly the greatest risk is the macroeconomic stability of the 14 countries and, mainly, their respective currencies. We are not so concerned about political stability because even many of those countries, for example Chad, even with armed conflicts or coups or changes of government, business continues to operate. Like the mining companies, a telephone company also continues to operate. The risk is the devaluation of the currencies and that those devaluations diminish the earnings in USD. Despite this risk, we also want to highlight that Airtel's growth, achieved and expected, far exceeds the levels of currency devaluation.

Help us by sharing our work!

From Airtel Africa IPO Prospectus

https://www.economist.com/special-report/2020/03/26/africas-population-will-double-by-2050

Network towers or ‘sites’: Physical network infrastructure comprising a base transmission system (BTS) which holds the radio transceivers (TRXs) that define a cell and coordinates the radio link protocols with the mobile device. It includes all ground-based, roof top and in-building solutions.

What a superb report on one of my larger holdings. Thank you.