SONA COMSTAR

A supplier of component for Electric Vehicles with high growth potential

TICKER: SONACOMS - MARKET CAP: ₹ 390.000 mln

SONA BLW Precision Forgings Limited is a public limited company registered and Corporate Office at Sona Enclave, Gurugram, Haryana, India.

SONA BLW is a leading automotive technology companies, designing, manufacturing and supplying highly engineered, mission critical automotive systems and components such as differential assemblies, differential gears, conventional and micro-hybrid starter motors, BSG systems, EV traction motors (BLDC and PMSM) and motor control units to automotive OEMs across US, Europe, India and China, for both electrified and nonelectrified powertrain segments.

The following map shows the locations of SONA COMSTAR manufacturing and assembly plants, R&D centres, warehouses, tool and die shop and sales office as at March 31, 2021.

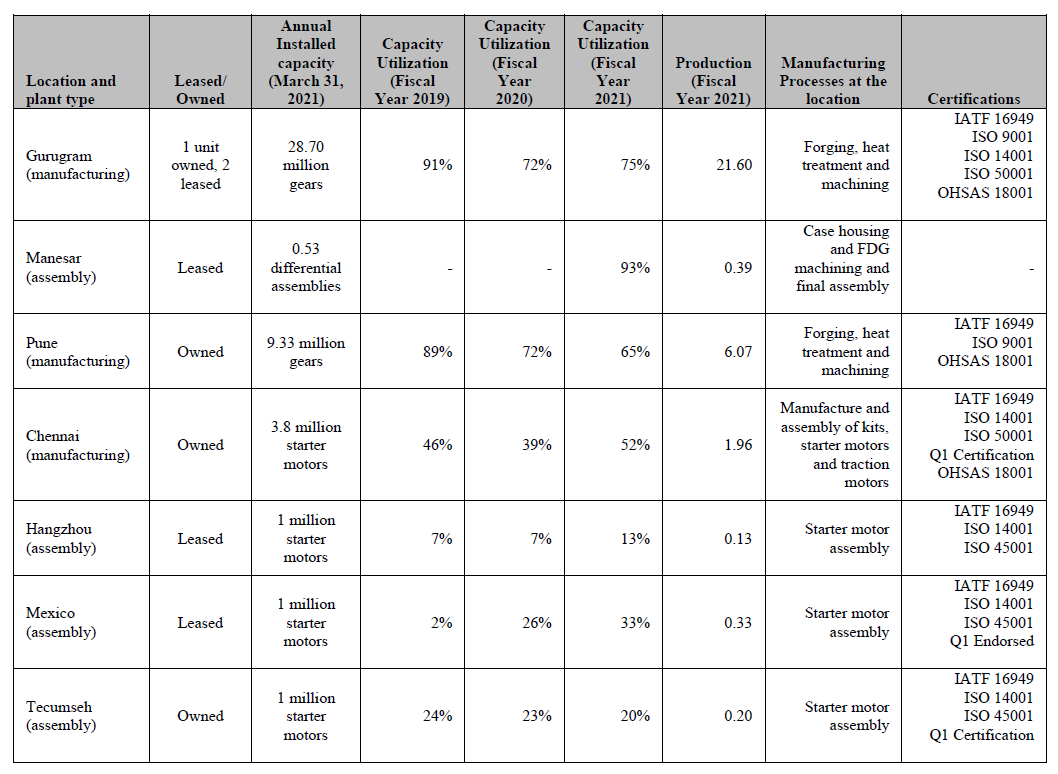

The table below sets forth certain details with respect to our manufacturing and assembly plants.

GROWTH FROM 1999

SONA BLW PRODUCTS

Differential Assembly: A mechanism including gears that transmits power to the wheels differently, allowing them to rotate at different speeds while executing a turn. Differential assembly is part of the drivetrain.

Differential Gears: Gear arrangement which goes into the differential assembly.

Starter-Motors (Micro-hybrid and conventional): Micro Hybrid- An electric device that apart from cranking the engine, automatically shuts the engine to reduce engine idle time.

Conventional- An electric device required to crank the engine and provide initial starting power to the engine.

BSG (Belt Starter Generator): Synchronous or asynchronous electric machine, which provides torque to the powertrain in motor mode and produces electricity in generator mode.

EV Traction Motors (BLDC & PMSM) and Motor control units: Synchronous Motors powered by direct current [DC) electicity to drive the electric vehicles - PMSM for BEV & Hybrid PVs. BLDC for electric 2Ws & 3Ws.

Motor Control Units regulate the power given to motors for providing the torque and speed to vehicle, and it also charges battery during braking.

MARKET SHARE and CUSTOMERS

Sona Comstar is the largest manufacturer in India of differential gears for PVs (Passenger Vehicles), with an estimated market share of 55% to 60%. Sona Comstar is the largest manufacturer in India of the CV (Commercial Vehicles) segment differential gears with estimated 80-90% market share. Sona Comstar is also the largest supplier of differential gears for tractor manufacturers in India, with an estimated market share of 75% to 85%.

Electric vehicle (EV) drivetrains are more complicated than conventional powertrains. Very high revolutions per minute (RPM) in electric drives cause noise, vibration and harshness (NVH) issues in EVs. This results in higher technological complexity in differential gears and assembly design. This in turn results in higher price realization for differential gear assembly in EVs than conventional powertrains.

ELECTRIC VEHICLES SITUATION IN INDIA

Currently, in India, the charging infrastructure required for EVs is not in place. With the Indian automobile industry seeing a slew of regulations and norms in the past few years, OEMs are skeptical about investing in EV manufacturing here.

The implementation of the National Electric Mobility Mission Plan, 2020 and other policy initiatives by the government to address infrastructure-related issues are key parameters to be monitored for the sector over the next five years. The government has announced Rs. 100 billion for Phase 2 of Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME). The policy aims to provide a subsidy of Rs. 10,000 per KWh to four wheelers (BEV (battery electric vehicle), PHEV, strong hybrid) for commercial purpose and public transport. It also mandates minimum range to be approximately 140 km and maximum ex-factory price to be approximately Rs. 1.5 million. It envisions creation of infrastructure for charging of EVs.

CRISIL Research expects the share of EVs in total passenger car sales to remain low (approximately 4%) in Fiscal 2026. Penetration in Fiscal 2019 was approximately 0.1%. EV penetration can be higher if government adopts stricter policies on OEMs for not meeting CAFÉ norms (Corporate Average Fuel Economy). The exact quantum of EV penetration in an aggressive case depends on incentives given for adoption and setting up of charging infrastructure.

The Indian two-wheeler electric vehicles (2W EV) story started in 2012 with the launch of the National Electric Mobility Mission Plan (NEMMP) 2020 that provides the vision and roadmap for faster adoption of EVs and their manufacturing in the country. 2Ws account for more than three-fourths of vehicles on Indian roads. Clearly, 2Ws would drive faster adoption of EVs in India. Over 2012-2015, the Indian 2W EV market was dominated by imports, mostly of lead-acid and low-speed electric scooters.

The Government of India launched the first phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme on April 1, 2015, to support the development of the hybrid and EV market. Under this scheme, demand incentives were provided to buyers (end-users/consumers) of 2W EVs – ranging from Rs. 7,000 for lead-acid vehicles to Rs. 26,000 for high-speed lithium-ion models. This provided a significant fillip to the 2W EV industry in India and resulted in several original equipment manufacturers (OEMs) foraying into the market.

Adoption of EV is contingent upon cost of acquisition and total cost of ownership of EVs over ICE alternatives. Among automobile segments, electrification in India will be led by three-wheelers and two-wheelers, while it will take longer for commercial vehicles and passenger vehicles to gain traction. Electrification in 2W will be led by lower total cost of ownership compared to ICE vehicles and suitable operating dynamics (running in shorter leads) compared to other vehicle segments. Whereas passenger vehicle to see slower electrification on account of higher cost of ownership and lack of availability of sufficient charging infrastructure.

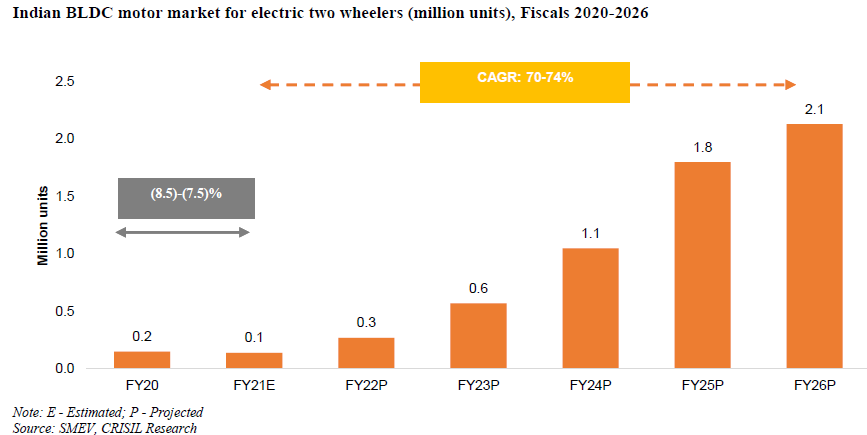

CRISIL Research expects 2W EV sales in India to expand to 2,130 thousand vehicles by Fiscal 2026 from 140 thousand to 142 thousand vehicles in Fiscal 2021, at a CAGR of 70% to 74% over Fiscals 2021 to 2026.

The e-3W segment is expected to grow at CAGR of approximately 46% between 2021 to 25 to reach 400,000 units in sales. The projected sales are the registered vehicles and the actual sales is likely to be much higher (>1 million units) as large portion of e-3W segment is unorganized. Passenger carriers are expected to dominate with approximately 80% market share.

REVENUE

Currently, Sona Comstar sells 36% of its products to the United States. Sales to Europe and China have been growing, mainly to China which rose from ₹ 257 mln in FY2020 to ₹ 1,129 mln in FY 2021.

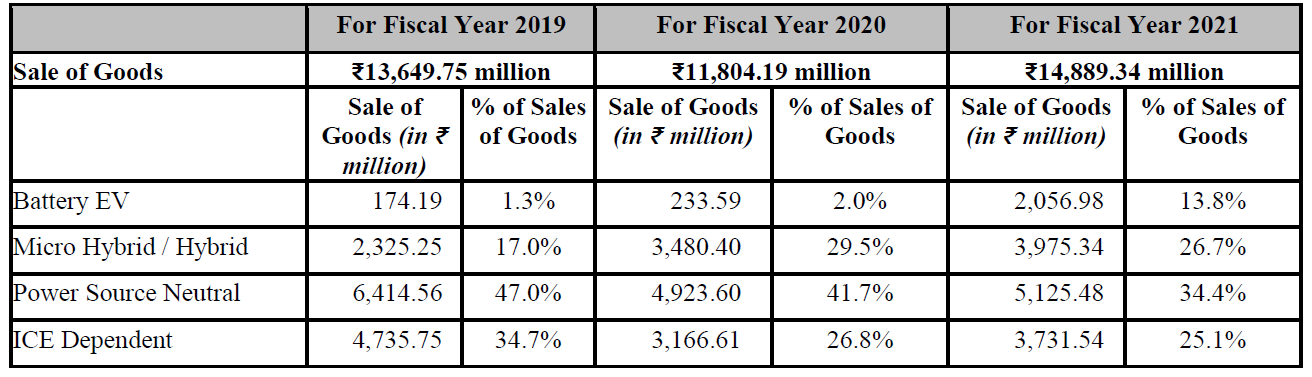

The table below sets forth the breakdown of Sona Comstar income from sale of goods across their systems and components, and as a percentage of the total sale of goods for the periods indicated.

The table below sets forth the breakdown of the income from sale of goods across powertrain, and as a percentage of the total sale of goods for the periods indicated. For Fiscal 2021, ₹11,157.80 million representing approximately 74.9% of their income, from sale of goods was derived from sale of goods to BEV, hybrid/ micro-hybrid and power source neutral products.

The Battery EV has no internal combustion engine or fuel tank at all and runs on a fully electric drivetrain powered by rechargeable batteries.

Micro Hybrid / Hybrid: The most common of the alternative fuel vehicles we see on the road these days are powered by a combination of an ICE and an electric motor (hybrid vehicle drivetrain). While the exact function of an HEV’s drivetrain may vary, fundamentally they all share the same characteristics of having a hybrid vehicle drivetrain and an electric battery, where either or both the ICE and electric motor power the drivetrain. The batteries can be charged in a few ways, either by spinning an electric generator when the ICE is operating or in some cases, by converting the vehicle’s kinetic energy into electric energy through systems like regenerative brakes.

Power Source Neutral: These engines are in many ways very similar to the HEV in that they have a hybrid vehicle drivetrain and use both an ICE and electric power. The big difference with these vehicles is that their rechargeable battery can be charged by plugging in to a power source. When the battery is depleted, the plug-in hybrid starts acting as a regular hybrid, with the combustion engine taking the role of primary power source.

ICE: Internal Combustion Engines

THE COMPANY'S EXPECTATIONS

“With SONA product offerings spanning across all types of conventional and electrified powertrains, SONA is one of the few automotive technology manufacturers that is well-positioned to gain from high growth industry trends as well as various initiatives introduced by the Government of India to facilitate the growth of the automotive industry in India”

- “BEVs are expected to grow at a CAGR of approximately 36% between calendar years 2020 to 2025 with increased market penetration, according to the Ricardo Report, which will be positive for us as we supply EV differential assemblies, differential gears, BSG systems and EV traction motors into this market. According to the Ricardo Report, BEV global vehicle production volume is expected to grow by five times in the next five years from 2.3 million units in calendar year 2020 to 11.2 million units in calendar year 2025. Further, revenue realization of various components is expected to change according to various degrees of electrification as stated in the Ricardo Report.”

- “Demand for electric two-wheelers is expected to grow at a CAGR of 72% to 74% between Fiscals 2021 to 2026, according to the CRISIL Report and the electric three-wheeler segment is expected to grow at a CAGR of approximately 46% between calendar years 2021 to 2025 to reach 400,000 units in sales, according to the Ricardo Report. We supply e-axles, BLDC motors and motor control units for use in the electric two-wheeler and three-wheeler segments.”

- “According to the Ricardo Report, 2030 targets for India indicate that 70% of all commercial PV, 30% of private PV, 40% of buses, 80% of two-wheeler and 80% of three-wheeler sales would be electric.”

- “According to the CRISIL Report, Indian CV and PV sales are expected to increase 9% to 10% CAGR and 12% to 14% CAGR, respectively, over Fiscals 2021 to 2026, with growth of 38% and 23%, respectively in Fiscal 2022. This will be positive for our differential gears business as our estimated market share of the Indian CV and PV markets is approximately 80% to 90% and 55% to 60%, respectively, according to the CRISIL Report.”

- “The mix of SUVs, CUVs, multi axle trucks and high powered EVs in the Indian and global PV and CV market is expected to increase according to the CRISIL Report and the Ricardo Report, leading to higher usage of differential gears per vehicle as these vehicles are AWD/4WD/multi-axle. We expect this trend to be positive for revenue growth of our differential gear business.”

CONCLUSION:

Sona Comstar's business model is quite simple. It produces components for different types of vehicles, be it cars, motorcycles or rickshaws. The interesting thing about Sona is that it does not produce auto parts not only for combustion cars, but also for electric cars. So we have a company with plants both inside and outside of India, but it also sells 75% of its products outside of India, and 75% of those products are for electric vehicles.

There are not many doubts regarding the growth and penetration that the electric car is having both in China and in Europe and the United States. Sona offers crystal clear exposure to the electric car market outside of India.

What about India? infrastructure and investment are still very far from allowing a replacement with own or external production. But what we found most interesting was the fact that 3/4 of the vehicles in India are motorcycles. In this area, there is an increase in the sales of electric motorcycles. And clearly Sona is a company that has the capacity to supply eventual producers of national electric motorcycles.

Only 5% of the revenue comes from the sale for the production of rickshaws and motorcycles. Let us bear in mind that the report that Sona Comstar cites in its issuance prospectus, estimates an annual growth of 74% sales of electric motorcycles until the year 2030 in India.

As the world discusses the nonsense Elon Musk tweets about taxes in India, Sona Comstar has the ability to capture a huge market, both outside and within India, not just for the electric car.

It is also noteworthy from good sources that Sona Comstar is the sole supplier of Differential Gears for the cars that Tesla manufactures in China, but Sona cannot make this public for confidentiality reasons. In fact this year it was rumored that Tesla was planning to open a plant in India, and that Sona would be one of Tesla's local suppliers.

Another interesting data is observed in the use of installed capacity. For example, the plant in Hangshou, China, was acquired in 2019, and is operating at only 13% of its capacity. In fact, none of the plants is working at 100% of its capacity, which suggests a possibility of increasing revenue without implementing a lot of Capex.

2Q 2022 FINANCIAL REPORT

For the first six months of fiscal 2022, Sona Comstar had an operating cash flow of ₹ 2,200 bln. If we annualize it, Sona BLW would be trading at 88 years of operating cash flow.

As another very favorable point, Sona BLW's debt is very low, only with Current Assets could it pay all its liabilities.

This is only a small part of all the material available to understand this huge company. From a valuation point of view, it is clear that the current Market Capitalization requires significant growth. We already know how companies with "growth" valuation behave: As long as you meet your goals and growth, the stock will go up. At the slightest doubt in relation to expectations, there may be sharp drops. From a business point of view, it is a more than interesting company to have in your portfolio.

We close this report with the words of the protagonists...